US Gold Prices Reach Record Highs Amid Economic Uncertainty

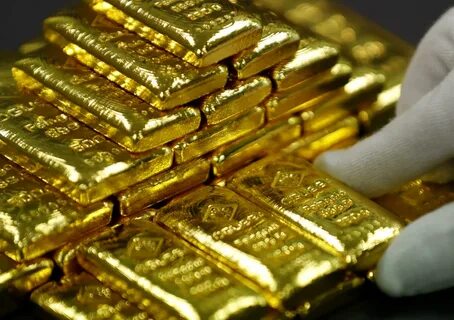

US gold prices have recently soared to unprecedented levels as investors seek out safe-haven assets amid increasing economic uncertainty. The surge in gold prices comes as the US economy continues to grapple with the effects of the global pandemic and geopolitical tensions. The precious metal has long been considered a reliable store of value during times of turmoil, and its current record highs reflect the growing apprehension among investors. As the US gold market experiences this unprecedented growth, it raises questions about the future trajectory of the economy and the broader implications for the financial markets.

US Gold Prices Reach Record Highs Amid Economic Uncertainty as investors seek safe-haven assets in response to the ongoing COVID-19 pandemic and concerns over global economic instability. The price of gold surpassed $2,000 per ounce, the highest level in history, as market volatility and low interest rates continued to drive demand for the precious metal. Analysts expect gold prices to remain high in the near term due to the uncertain economic outlook and potential market risks.

Uncovering the Treasures: The History of US Gold

Uncovering the Treasures: The History of US Gold is a comprehensive account of the role gold has played in shaping the history of the United States. From the Gold Rush era to the establishment of the US Mint and the adoption of the gold standard, this book delves into the economic, social, and political impacts of gold throughout American history. Additionally, it explores the significance of gold in international trade, monetary policy, and global economic systems. This book is a must-read for anyone interested in understanding the historical significance of gold in the United States.

Shining Bright: Investing in US Gold

Shining Bright: Investing in US Gold is a financial service that offers individuals the opportunity to invest in gold, particularly within the United States market. This can include purchasing gold coins, bars, or other forms of physical gold, as well as investing in gold-related financial products such as ETFs or gold mining stocks. The company may also provide educational resources and guidance to help individuals make informed decisions about their gold investments.

Glittering Legacy: Exploring US Gold Mines

Glittering Legacy: Exploring US Gold Mines is a documentary series that delves into the history, technology, and human stories behind some of America’s most significant gold mines. The series showcases the challenges and triumphs of gold mining in the United States, providing a comprehensive look at the industry’s impact on the nation’s economy and culture. Through interviews, historical footage, and on-site exploration, the series offers a compelling and informative insight into the world of gold mining in the US.

Golden Opportunity: Understanding US Gold Reserves

See also: gold detector metal detector

Golden Opportunity: Understanding US Gold Reserves is a comprehensive guide that delves into the history, significance, and management of the United States’ gold reserves. The book provides a detailed analysis of the factors that influence the country’s gold reserves, including economic policies, geopolitical considerations, and market dynamics. It also offers insights into the role of gold in the global economy and its potential impact on financial markets. Additionally, the book explores the implications of the US gold reserves on monetary policy and the overall stability of the nation’s economy. With in-depth research and expert analysis, Golden Opportunity provides readers with a deeper understanding of the complexities surrounding US gold reserves and their broader implications.

All That Glitters: The Future of US Gold Production

All That Glitters: The Future of US Gold Production is a report that explores the potential for increased gold production in the United States. The report examines various factors including technological advancements, regulatory challenges, and market trends that could impact the future of gold mining in the US. It also provides insights into potential opportunities and risks for investors and stakeholders in the gold mining industry. The report aims to provide a comprehensive analysis of the US gold production landscape and offer valuable insights for decision-makers in the industry.

Digging Deeper: The Economic Impact of US Gold Mining

Digging Deeper: The Economic Impact of US Gold Mining is a comprehensive report that delves into the economic implications of gold mining in the United States. The report examines the various aspects of gold mining, including its contributions to job creation, local economies, and overall economic growth. It also analyzes the environmental and social impacts of the industry, offering a well-rounded view of the effects of gold mining. This in-depth analysis provides valuable insights for policymakers, industry stakeholders, and the general public to understand the complex nature of gold mining and its economic significance.

Golden Years: US Gold Coins and Collectibles

Golden Years: US Gold Coins and Collectibles is a reputable company that specializes in dealing with US gold coins and collectibles. They offer a wide range of products for collectors and investors, including rare and historic coins, bullion, and other precious metal items. The company is known for its high quality and authentic products, as well as its knowledgeable and professional staff. Whether you are a seasoned collector or a first-time buyer, Golden Years can help you find the perfect addition to your collection.

Metal of Kings: The Cultural Significance of US Gold

Metal of Kings: The Cultural Significance of US Gold is a book that explores the historical and cultural significance of gold in the United States. It delves into the role of gold in shaping American identity and the impact of gold rushes on the country’s development. The book also examines the cultural and economic impact of gold mining and its influence on art, literature, and popular culture. Through a comprehensive analysis, Metal of Kings offers a compelling insight into the enduring legacy of gold in American society.

Gilded Age: US Gold Rushes and Prospecting

The Gilded Age in the United States was a period of rapid economic growth and industrialization in the late 19th century. During this time, there were several gold rushes and a significant amount of prospecting throughout the country.

The California Gold Rush of 1848-1855 is perhaps the most well-known, drawing people from all over the world to seek their fortunes in the gold fields. This was followed by other gold rushes in places such as Colorado, Alaska, and the Black Hills of South Dakota.

Prospecting for gold and other valuable minerals was a common occupation during the Gilded Age, with many people staking their claims and setting up mining operations. This led to the development of boomtowns and the growth of industries related to mining, such as transportation and infrastructure.

The impact of the gold rushes and prospecting during the Gilded Age was significant, shaping the economy and society of the United States during this era. The wealth and resources extracted from the land during this time also played a crucial role in the country’s industrial development and westward expansion.

Fort Knox and Beyond: Securing US Gold Holdings

Fort Knox is a United States Army post in Kentucky, best known for its central role in storing the country’s gold reserves. The United States Bullion Depository, often referred to as Fort Knox, is a highly secure facility that holds a significant portion of the nation’s gold holdings. The precise amount of gold stored at Fort Knox is not publicly disclosed, but it is known to be a substantial portion of the US government’s total gold reserves.

The facility is heavily guarded and protected, with multiple layers of security measures in place to prevent unauthorized access or theft. Security at Fort Knox includes armed guards, electronic surveillance, and other advanced security technologies. The high level of security is intended to safeguard the US gold holdings and prevent any potential threats or theft attempts.

In addition to Fort Knox, the US government also stores gold reserves at other locations, both within the country and abroad. These storage facilities are also heavily secured and closely monitored to ensure the safety and integrity of the nation’s gold reserves.

Overall, the security measures in place at Fort Knox and other storage facilities are designed to protect the US gold holdings, which are a critical asset for the nation’s economy and financial stability.

In conclusion, the record high US gold prices reflect the current economic uncertainty and investors’ increasing demand for safe-haven assets. As the US dollar continues to weaken and global tensions persist, the price of US gold is expected to remain high, offering a potential hedge against market volatility for investors.

See also

https://www.gold.fr/

https://www.bullionbypost.fr/cours-de-lor/cours-de-lor-actuel/

https://or.fr/cours/or

https://www.aucoffre.com/cours-or

https://www.bullionbypost.fr/cours-de-lor/cours-de-lor-aujourdhui/